This is the first of a two-part series of articles on disruption and the importance of customer centricity. The second article will be shared in March’s newsletter.

In general, most people are resistant to change. However, one thing great leaders do is use the disruption for change. The COVID-19 pandemic is a perfect example. We can point to dozens of examples of companies, organizations, and the service industry who capitalized on this disturbance to address the needs of their customers and even gained new customers in the process by creating products and services to address these requirements.

C-suite executives who took this challenge turned it into opportunities. Is it too late to consider changes within your business? No, it’s not, and here are some ways to approach it.

Prioritizing Change

First, executives must determine what changes might be needed and then prioritize them. Sherzod Odilove, senior consultant and organizational effectiveness lead at Gallup, states that instead of wishing a crisis away, world-class leaders lean in and ask, ‘Which organizational change(s) should we prioritize?’

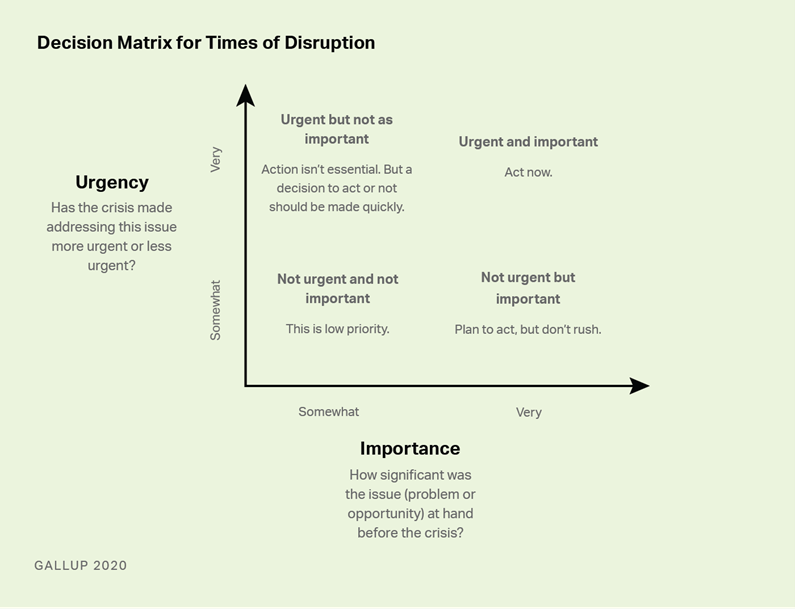

This decision matrix from Gallup® outlines the process.

Gallup has also identified seven principles leaders can use for effective change management.

- Clearly articulate the vision for change.

- Involve the right people: limited vs. broad involvement.

- Communicate the right information at the right time.

- Always account for resistance to change.

- Celebrate short-term wins without declaring premature victory.

- Effectively anchor the change to the organization.

- Always plan for change to be “the only constant.”

Finally, Gallup believes the best predictors of 0rganizational change success are strong leadership and engaged employees. Thriving organizations make strong company cultures and strong customer-centric practices important pieces of their business mission.

Next month’s article will share methods to build and strengthen customer relationships and why that is important in the change management decision-making process.