U.S. job openings rose in January by more than forecast, to an almost one-year high, bolstering projections for a faster pace of hiring as more Americans receive coronavirus vaccines and demand quickens. Read more here: Record Level Job Openings

With the recession going on because of the coronavirus pandemic, many companies are reducing their workforce in response to changes in operations. As a result, your organization’s unemployment claims may be increasing. If so, your experience ratings are being reevaluated, which can cause your state unemployment tax rates to increase. Therefore, you need to know how you can minimize the impact of unemployment claims on your business.

Discover five ways unemployment claims impact your company and what you can do about it.

Minimize Your Terminations and Reductions in Force

Reduce your number of terminations and reductions in force as much as possible. Some employees who lost a job could claim unemployment benefits if they were terminated due to financial cutbacks, because they weren’t a good fit for the job, or because of a minor incident. These numbers affect your state unemployment tax rates. To avoid termination or reduction, consider a furlough or temporary reduction in hours or pay.

Check Your Base Year Employer Forms

Pay close attention to the Notice to Base Year Employer forms you receive. These come when a former employee becomes separated from their next employer and files for unemployment benefits. The forms show the percentage of their unemployment you’ll be charged unless you respond within 30 days. Your response can limit the number of benefits your company ends up paying.

Your Account May Be Charged for an Employee Who Quits

Be aware that your state unemployment insurance account can be charged for an employee who quits because of reasons attributable to your company. For instance, a change in the worksite may increase the employee’s commute or difficulty of travel. Because the amount of money you pay in unemployment benefits is related to the number of former employees who collect payments after leaving your company, you want to keep this number to a minimum.

Protect Your Company with Documentation

Maintain detailed records on each employee. Clear documentation can prove the validity of your response to an unemployment benefits claim. Your records should include employment policies, job descriptions, contracts, offers, and other job-related information. Have the employee sign every document to show they reviewed and understood the information.

Manage Your Workforce with a Staffing Agency

One of the best ways to manage your fluctuating workforce needs is to partner with a staffing agency. Because the agency bears the liability for temporary and contract employees, it also is responsible for their unemployment benefits. You can blend temporary or contract employees with your full-time staff with no financial impact on your company when they leave.

Hire Accounting and Finance Professionals

Unemployment claims have a significant impact on your company’s bottom line. Implementing the above tips to reduce the expenses related to your unemployment insurance can help your company save money long-term.

When you need help reducing the amount of money your organization spends, get in touch with Casey Accounting & Finance Resources. Our staffing consultants can provide innovative and creative solutions that exceed your expectations. Get more information today.

Diamond Award winners have won the Best of Staffing Award for at least five years in a row, consistently earning industry-leading satisfaction scores from their clients and job seekers.

The staff of Casey Accounting & Finance Resources (www.caseyresources.com) is pleased to announce they have earned ClearlyRated’s Best of Staffing® Talent Diamond Awards for providing superior service to their job candidates for at least five years in a row. Presented in partnership with presenting sponsor, CareerBuilder, and gold sponsors Indeed and Glassdoor, ClearlyRated’s Best of Staffing Diamond winners have proven to be industry leaders in service quality based entirely on ratings provided by their candidates. This is the sixth consecutive year the company has won the Talent Satisfaction award. Less than 1% of staffing companies earn the Diamond award for Best of Staffing.

Focused on helping companies find the right people for their job openings, Casey Accounting and Finance Resources received a Net Promoter Scores (NPS) are 88.2% for talent satisfaction, far exceeding the industry average of 18%. The NPS question of “how likely is it that you would recommend XYZ company to a friend or colleague?” created by Fred Reichheld determines the tier of how strong your customer service is. Anything above 70% NPS is at the top of the echelon and considered ‘world-class service.’

We want to thank all of our associates and job seekers for trusting our team. We appreciate you and look forward to ongoing partnerships with you.

This is the second of a two-part series of articles on disruption and the importance of customer-centricity. The first part of this series was published in February’s newsletter.

In this article, we’ll discuss the best predictors of successful organizational change. But first, let’s summarize the key highlights of last month’s article on How to use Disruption as an Opportunity for Change:

- Most people are resistant to change, yet great leaders use disruption for capitalizing on change and improving customer-centricity.

- The ways to prioritize change, and taking challenges, and turning them into opportunities included:

- Gallup has also identified seven principles leaders can use for effective change management.

- Clearly articulate the vision for change.

- Involve the right people: limited vs. broad involvement.

- Communicate the right information at the right time.

- Always account for resistance to change.

- Celebrate short-term wins without declaring premature victory.

- Effectively anchor the change to the organization.

- Always plan for change to be “the only constant.”

The Best Predictors of Successful Organizational Change

According to Gallup, the best predictors of successful organizational change are strong leadership and engaged employees. Plenty of articles outline successful organizations that have strong company cultures and strong customer-centric practices. So, how does this help with the change management process? Forrester Research states that to succeed, customer-centricity should be embedded in the way you do business. Therefore customers must be made the focal point of your business strategy and operations. Customer-centric organizations set high expectations for their employees to provide extraordinary experiences to customers, and in turn, customers reward these companies with trust. Customer-centric organizations also collect various data points that help determine ways to provide customers with better and additional services and products that, in turn, make their customers successful. Altogether, this knowledge helps drive decision-making processes, regardless of disruption. We all know that creating a strong customer-centric culture isn’t for the faint of heart, and it requires an ongoing commitment throughout the organization. What customer-centric organizations do well is they continuously build and strengthen customer relationships. So, how have they continued this strong bond during COVID-19, where everything is virtual? Scott Steinberg, a futurist and keynote speaker, offers these best practices to create meaningful relationships from a distance. Here are excerpts from one of his articles. To read the entire article, click here.1. Create good reasons to be in contact.

Tactical takeaway: Rather than attempt routine check-ins with clients, instead create cleverly-packaged offers that help customers solve pressing problems—then creatively pitch these programs as can’t-miss insights, educational programs, and events.2. Make a point to show your appreciation.

Tactical takeaway: Create fun, quirky and heartwarming mailers to surprise and delight your customers (and help you stay on their radar) with a message of appreciation or unexpected goodwill and cheer. Or, set up a virtual lunch and send your client’s favorite meal to his or her desk.3. Become a go-to source of insight and education.

Tactical takeaway: Distill your expertise and insight into articles, guides, e-books, whitepapers, social media posts, videos, and other snackable content that can quickly steer clients towards the answers they need to help deal with ongoing challenges and disruptions.4. Shine a spotlight on your clients.

Tactical takeaway: Establish partner-focused programs and publishing channels that put customers (and customer stories) front and center to show your appreciation, offer support and build awareness for their hard work and efforts.5. Source partner feedback and input.

Tactical takeaway: Invite clients to offer feedback and input into the development process, create more opportunities for customers to share their opinion, and look for ways to promote greater ongoing collaboration. Steinberg comments, “The way forward in challenging times is always to work together – and, as ever, you and your customers can continue to do so successfully simply by looking for clever and creative ways to work (albeit digitally for the moment); hand-in-hand.” It’s never too late to lean into improved customer-centricity regardless of disruption. Don’t waste this opportunity to implement some or all these ideas or create your own.Happy to share thought leadership from SHRM. hr-today_trends-and-forecasting_research-and-surveys_ February 2021

With two COVID vaccines available in the U.S. as of February 2021, healthcare workers, nursing home residents, and other vulnerable people are already receiving them. Once these people are vaccinated, frontline essential workers, people over 65, and other select groups should be next in line. As an accounting & finance manager, you may be wondering what this could mean for your team. If you are still working remotely, odds are you want to get back to the office at least partially and resume some normalcy.

Here’s how soon your team members may be able to receive the COVID vaccine.

The Public Might Get Vaccines in Spring

According to Dr. Anthony Fauci, Director of the National Institute of Allergy and Infectious Diseases, if an estimated quarter of US residents is fully vaccinated by late Spring or early Summer 2021, then healthy members of the general public may be able to get vaccinated more quickly than originally thought. The distribution would still take place over several months.

Employer Guidance May Increase Vaccination Efforts

Employers have the right to require employees to get vaccinated as a condition of returning to the office. This may help staff overcome their reluctance to get the vaccine as soon as possible. However, making something in the workplace mandatory typically leads to less desirable results than keeping it voluntary. Employees may object for reasons related to religion, ethics, disability, pregnancy, allergic reactions to previous vaccinations, or other issues. Instead, weekly COVID testing may become common for those returning to the office.

Continue to Wear a Mask

The process of vaccinating hundreds of millions of people to develop herd immunity is expected to take months. In fact, Fauci believes that 75-85% of the U.S. would need to be vaccinated by Fall 2021 to get back to some degree of normalcy. Ideally, the majority of people would need to get vaccinated to stunt or completely stop the outbreak. With the recent reports of new COVID-19 strains occurring throughout the world, social distancing, wearing masks, and vaccinations may remain the norm for some time.

Recommendations for Your Accounting and Finance Team

Although the COVID vaccine may be available to the general public in Spring 2021, there is no guarantee that everyone will want it. Also, even though employers can make vaccination a requirement to return to the office, staff members may object for religious, ethical, or other reasons. A better solution may require regularly scheduled COVID testing along with mask-wearing, social distancing, and other health standards to stop the spread.

Whether working remotely or on-site, enhance your accounting & finance team with Casey Accounting & Finance Resources help. Our in-depth understanding of the industry’s necessary functions and competencies and a role ensures that only highly qualified candidates are presented for your review. Contact us today.

The level of engagement an employee has demonstrated how committed they are to your company and its success. It also shows how motivated and emotionally invested they are in their work. An employee must be motivated to work toward a goal in line with its vision and committed to the same values as the organization to remain engaged. As a result, the higher employee engagement is, the greater your company’s success. This is why you must work to maintain engagement among your team members.

Implement these tips to ensure your accounting and finance team remains engaged in their work.

Get to Know Your Employees

Learn all you can about your team members. For instance, find out about their families, hobbies, and interests. Also, discover what motivates them to perform their best. Additionally, ask what keeps them invested in the company’s future. Plus, uncover how they’d like to expand the business and increase its success. Use this knowledge to create a positive, productive work environment.

Set Goals

Create individual and team goals that are both challenging and realistic. This provides a sense of direction for what needs to be done and where your team members should focus their energy. Be sure to include milestones along the way to measure both progress and success.

Offer Growth Opportunities

Provide opportunities for professional growth. For instance, create stretch assignments that increase team members’ skill sets. Also, encourage your staff to develop and implement ideas to increase efficiency within the department. Plus, offer additional training and coaching in line with promotions.

Maintain Communication

Keep the lines of communication open with your team. For instance, encourage open discussion about problems as they come up. Work together to find solutions. Also, ask for employee feedback to improve your performance. Additionally, keep your staff updated on company news and developments.

Promote Autonomy

Let your teamwork as independently as possible. This shows you trust them to complete their tasks without being watched over. Ensure you clearly communicate what needs to be done and make yourself available to answer questions. Also, regularly check in on your team’s progress to see how they’re doing and provide feedback. Plus, encourage them to learn from their mistakes and do better next time.

Recognize Achievements

Acknowledge individual and team accomplishments. For instance, thank your team members for their efforts. Also, point out how individual contributions led up to a finished product. Provide monetary rewards for major achievements.

Hire Engaged Accounting & Finance Professionals

The promotion of employee engagement is one key to your accounting and finance team’s success. Engaged team members produce at higher levels and remain with your company longer. Setting goals, maintaining communication, and promoting autonomy are three ways to encourage engagement.

When you need to add engaged professionals to your team, partner with Casey Accounting & Finance Resources, we provide high-performance candidates who will make strong contributions to your company. Find out more today.

This is the first of a two-part series of articles on disruption and the importance of customer centricity. The second article will be shared in March’s newsletter.

In general, most people are resistant to change. However, one thing great leaders do is use the disruption for change. The COVID-19 pandemic is a perfect example. We can point to dozens of examples of companies, organizations, and the service industry who capitalized on this disturbance to address the needs of their customers and even gained new customers in the process by creating products and services to address these requirements.

C-suite executives who took this challenge turned it into opportunities. Is it too late to consider changes within your business? No, it’s not, and here are some ways to approach it.

Prioritizing Change

First, executives must determine what changes might be needed and then prioritize them. Sherzod Odilove, senior consultant and organizational effectiveness lead at Gallup, states that instead of wishing a crisis away, world-class leaders lean in and ask, ‘Which organizational change(s) should we prioritize?’

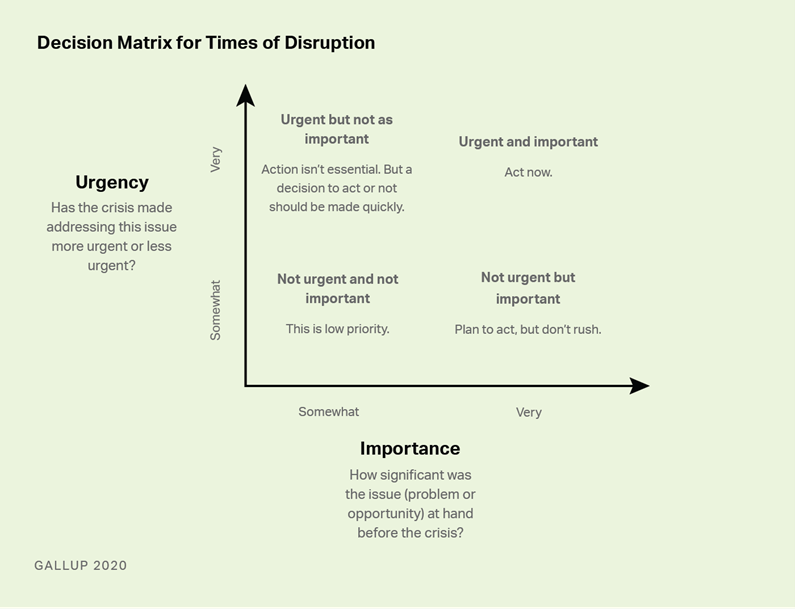

This decision matrix from Gallup® outlines the process.

Gallup has also identified seven principles leaders can use for effective change management.

- Clearly articulate the vision for change.

- Involve the right people: limited vs. broad involvement.

- Communicate the right information at the right time.

- Always account for resistance to change.

- Celebrate short-term wins without declaring premature victory.

- Effectively anchor the change to the organization.

- Always plan for change to be “the only constant.”

Finally, Gallup believes the best predictors of 0rganizational change success are strong leadership and engaged employees. Thriving organizations make strong company cultures and strong customer-centric practices important pieces of their business mission.

Next month’s article will share methods to build and strengthen customer relationships and why that is important in the change management decision-making process.

The 9-5 workday was created by American labor unions in the 1800s. It was made popular in the 1920s by Henry Ford, who wanted to attract auto workers used to 12-hour shifts. Because today’s employees are accustomed to working 8-hour days, many still accept the setup. However, every aspect of working life has changed in the past century. With an increasing emphasis on organizing lives for greater work-life balance, it is time to replace a set workday with flexible hours.

Here are three reasons to modify your company’s work week with flexible hours.

Desire for Flexibility

Millennials, who make up the largest percentage of the workforce, want jobs that provide flexibility. Because work-life balance is a priority, they prefer the ability to set their own hours and work remotely more than have steady work or the highest possible pay. Allowing staff to take care of personal responsibilities while finishing their work tasks provides an increased sense of control over their lives. Employers who offer flextime typically have higher performance, increased job satisfaction, and lower turnover than employers who do not. This results in greater customer satisfaction and higher revenue.

Working at Peak Hours

Companies have automated most of the rote elements of work that used to comprise the 9- 5 workday. Because calculations, factory work, and typing jobs that were common in the 20th century have been automated, employees have more time for problem-solving activities. Although drowsy workers still could accurately put together parts on an assembly line, distracted workers in the creative sector cannot solve problems very well. They need to use their individual mental energy rhythms to find creative solutions. As a result, employees should be allowed to work when they are at peak performance. Whether early in the morning or late at night, staff should have wide parameters with minimal rules to complete their work in.

Greater Productivity

Research performed by businesses, industry associations, and academic institutions shows that average workers do not get more done in a 10-hour day than an 8-hour day. In fact, every hour worked beyond 40 per week reduces productivity and output both short- and long-term. As a result, productivity should be measured by the quality of output rather than hours put in.

Add Flexible Staff

Providing a flexible schedule for staff means changing your work culture. Allowing for increased work-life balance attracts and retains top-performing workers who remain engaged and productive throughout the day. Your company benefits from increased retention, customer service, and profits.

When your accounting & finance team needs to add members, get in touch with Casey Accounting & Finance Resources. As a recipient of the Best of Staffing Client Satisfaction award every year from 2016 to 2020, our team can provide you with the highest caliber of professionals in the field. Learn more today.

The scope of the coronavirus pandemic caught everyone by surprise. The impact has been felt by companies of all sizes in all industries. Tough decisions continue to be made regarding layoffs, policy changes, hiring, and how to keep the doors open. Fortunate companies have been able to use creativity, planning, and help from outside sources to maintain operations. The lessons we learned from coping with the unexpected can be used to navigate through other crises.

Here are three significant lessons businesses learned from the coronavirus pandemic.

Act Fast

When the COVID-19 pandemic began hitting countries, we had to go on lockdown for an extended period of time. The hospitality industry was shut down. International travel was forbidden. A significant part of the economy stopped. Companies had to make quick decisions with little information. Because employee safety was a top priority, leadership came up with remote working programs. Since business operations and revenue generation had to continue, leadership assessed their organization’s strengths and weaknesses, changed procedures and processes, created new products and services, and altered the business as quickly as possible. Overall, employers learned to be prepared for the unexpected. Contingency and crisis plans need to be top priorities going forward.

Prioritize Needs

During the early stages of the coronavirus pandemic, employers put the health and safety of their employees first. For millions, this meant transitioning in-office staff to work from home. Companies that had to provide employees with laptops, webcams, and headphones or increase their subscription to a videoconferencing platform faced a substantial impact on their bottom line. Employers’ second priority was survival of the business. Leadership had to discover which products and services were more profitable, which channels attracted more customers, and which campaigns resulted in more leads. The rest was put on hold. Leadership also assessed and pursued the development plans that offered a quick advantage over the competition. They learned that focus and resources needed to be shifted to the most resilient areas with revenue potential.

Reinvent the Company

A substantial number of companies had to reinvent themselves after the coronavirus hit. Leadership found new channels to interact with customers, new market opportunities, and new products to address emerging needs. They also modified manufacturing facilities, discovered new selling channels, and imagined new campaigns and promotions to promote sales. For instance, many companies that sold cleaning services, which were no longer in demand, began offering sanitation services for retail and healthcare clients. Companies had to evolve with changing customer needs to stay relevant.

Partner with a Top Recruiting Firm

The COVID-19 pandemic taught us to act fast when a crisis hits. Company needs must be prioritized, beginning with employee health and safety. Leadership must reinvent the business in order to continue filling customer needs.

Because these actions all require substantial resources, many companies turned to Casey Accounting & Finance Resources for help. Our dedicated team of professionals provided them with superior value through innovation, creativity, and initiative. Find out how our team can help your organization as well.\